30 VC Firms Walk Into a Bar…and Leave With $49B

Wow Man It's An Analysis of Fundraising Challenges for Emerging and Experienced Managers So You Don't Freak Out And Can Keep Your Eyes On The Road And Your Hands Upon The Wheel

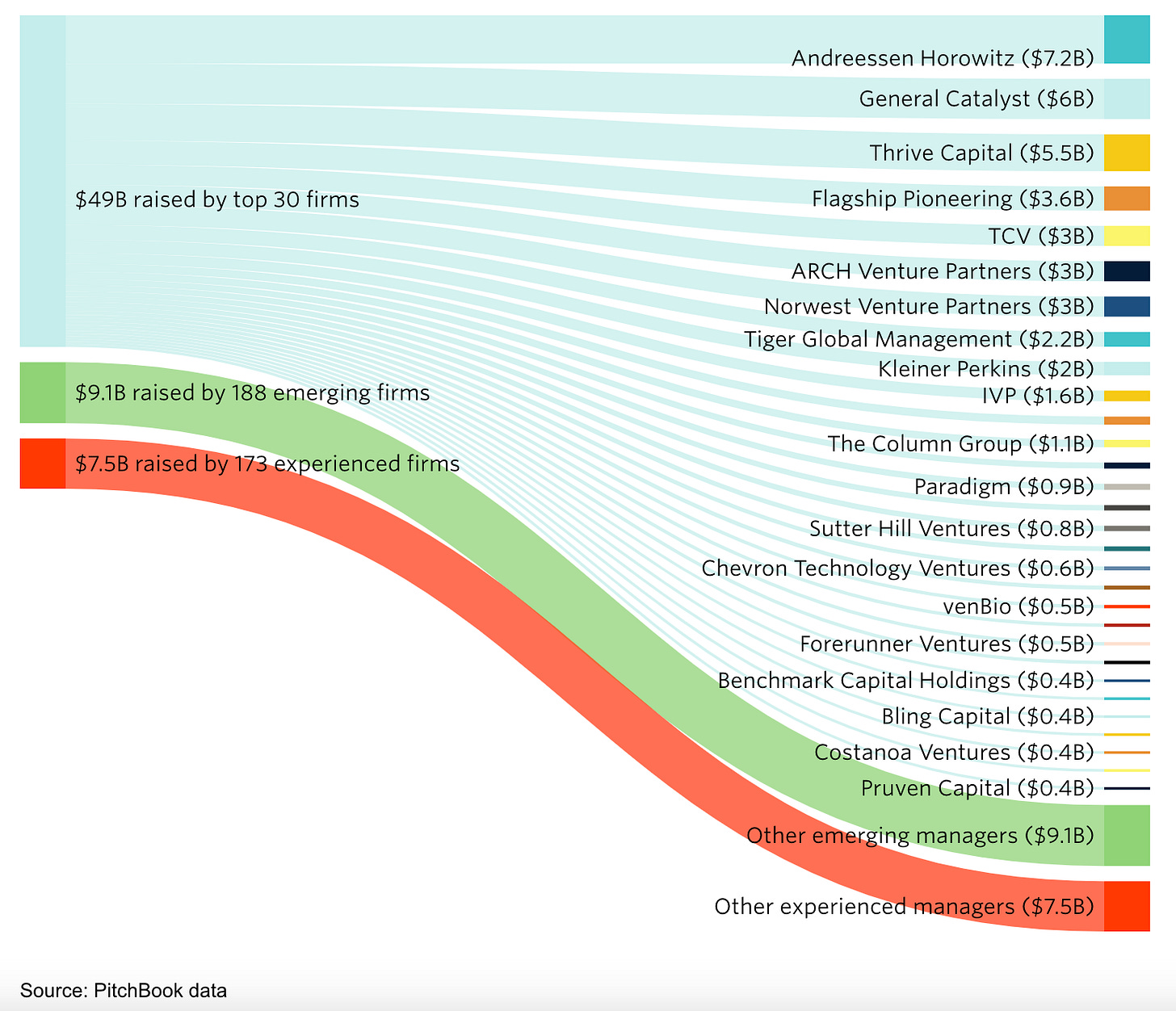

75% of of all venture capital was raised by 30 funds this year.

Pitchbook just released this data yesterday, and it’s crucial for emerging fund managers and anyone raising a first, second, or third fund in VC or PE.

Even fund managers in other asset classes should pay attention, because many of the same LPs are likely involved. This data provides important insights into the current fundraising environment and its implications across the board.

This dataset underscores the widening gap between the top-tier VC funds and, uh, well, everybody else.

This isn’t just about a disparity in numbers—it reflects a broader trend in LP behavior, risk aversion, and the evolving landscape of capital allocation. Whether you're a first-time fund manager or working on your third raise, understanding these dynamics is critical. Unless you want to spend a lot more to raise your fund than you really need to.

The Free Section: Key Nuggets from the Data

Pitchbook’s data shows a stark concentration of capital within these 30 VC firms. Collectively, they raised $49B. That’s 75% of all VC raised in the U.S. this year.

This trend underscores a rough environment for newer and smaller funds, as well as for experienced managers who aren’t in the top tier.

The Key Takeaways:

Concentration of Capital:

Top-tier firms like Andreessen Horowitz and General Catalyst dominate fundraising, attracting LPs with proven track records.

Emerging managers face steep competition as LPs concentrate their allocations.

Remember, LPs are here for wealth preservation - these firms have proved they are stellar at it.

Opportunities for Emerging Managers:

Despite the challenges, 188 emerging managers successfully secured $9.1B in funding—outpacing the $7.5B raised by 173 experienced managers outside the top 30. This performance demonstrates that emerging managers remain a viable and competitive option in today’s fundraising landscape.

LPs remain interested in compelling, differentiated strategies from newer players.

Challenges for Experienced Managers:

Experienced managers outside the top tier struggle, often losing ground to well-established brands.

Differentiation and innovative approaches are crucial for breaking through.

Success hinges on showcasing clear, standout factors such as unique market insights, strong operational efficiencies, or partnerships that provide a competitive edge.

Conversely, reliance on generalist approaches or overlapping strategies with top-tier firms tends to underperform.

Want to know how to turn these insights into actionable fundraising strategies? Read on for advice tailored to first-, second-, and third-time fund managers, along with general recommendations that apply across the board.

Want to join the first 25 minutes of office hours this coming Monday at 1pm PT (4pm ET)? We’re going to talk about how to Find An Anchor Investor for your fund. Sign up here! We have space for about 90 investment firms.

[Doors photo courtesy of the amazing Henry Diltz]

Keep reading with a 7-day free trial

Subscribe to LP Blueprint to keep reading this post and get 7 days of free access to the full post archives.