Yesterday, we saw that Sapphire’s Beezer Clarkson, who we interviewed in February, shared an interesting year-end report on LinkedIn. It was called The Great Recalibration - Small VC Fundraising in 2025. It’s an analysis of 48 funds by 30 firms. Been a fan of what Beezer’s team has done with content at OpenLP for some time.

So, yeah. 2025’s over, and the data’s in.

It’s proving something we’ve known for a while: emerging fund capital formation just got harder. Like, a lot harder.

But don’t freak out. If you’re reading LPB, you’ve got a plan.

We could summarize this report for you like every other newsletter. You’d get the headlines, the trends, and the whole “what it means for LPs.”

Anybody can do that.

What we do here is different.

We know exactly what’s hard about raising for emerging fund managers.

We’ve been there. We’re advising 147+ firms right now and directly advising on $680M+ of raises, day to day. Like week-to-week, knowing the entire forecast.

We know capital formation better than anyone in the emerging manager space. We have those flying monkeys from the Wizard of Oz and they are ready to fight.

So when the 2025 data came out, we didn’t ask “what’s interesting?” We asked “what’s actually going to stress out GPs in 2026?”

Here’s what this report actually proves about what you’re about to face.

Data: 48 funds, 30 firms. What they experienced in 2025. What you’re about to experience. We do not share stuff like this to create FUD or scare anyone. That is against our values. We also do not use FUD to sell. Also against our values. The opposite.

We want our clients to be prepared, smart and relaxed.

The Timeline Problem You’re About to Hit

2024: Fundraising difficulty at 2.43/5

2025: Fundraising difficulty at 3.93/5

62% increase in one year. In 2026, that stays locked.

Here’s what it means: Your fund is closing 6-8 months longer than it used to.

That’s a pay cut.

That’s not just a market stat. That’s money out of your pocket.

That’s runway.

Here's the real squeeze: You need $300-400K to run ops pre-Close 1. And that needs to include actual salaries for you and your co-GPs. Not someday.

Now.

If you're trying to bootstrap a fund without paying your team, you're sending a signal to LPs: we're not that serious about this.

We look for the opposite. GPs who commit to paying themselves. That's conviction. That's what we want to see.

If you’re raising in 2026, expect 16-18 months from first close to final close. Maybe 20 if the capital is institutional (it usually is). If you’re doing 50M+, it’s institutional.

This is the thing nobody talks about. This is where the actual stress lives.

The Approval Stamp You’re Counting On? It’s Worth Half What It Was.

Before Q1 2022: 93% of small funds had multi-stage VC backing. This is stuff like a16z, Sequoia, etc.

In the boom years, nearly all small funds (93%) had a big VC firm backing them.

Today: 32% raise without it.

Translation: The credibility shortcut?

It’s basically gone. Don’t count on it in 2026.

Direct MSVC investments dropped 44% (57.1% → 32.1%)

Partner checks dropped 27% (78.6% → 57.1%)

You can’t use a multi-stage VC co-sign to shorten your sales cycle anymore. The capital formation pathway you might have been counting on, well, it’s probably been cut off. We can talk about whether it’s realistic. Feel free to reply to this email. If you are in Capital OS Platform or any of our programs just send us your “hit list.”

Also, I just received a series of GP Velocity submissions in the last day or two with VERY long fundraising timelines, like 24-30 months. Please do not wait that long before submitting.

Combined with the timeline problem: You need way faster sales cycles. You don’t have the co-sign. You need new capital sources. All of that makes timelines even longer. Which means more personal burn. You DO NOT WANT PERSONAL BURN. YOUR SPOUSE OR ROMANTIC PARTNER IS NOT DOWN FOR IT IF THEY SHARE MONEY WITH YOU.

The Capital Source Just Changed

What you’re about to experience: The easy money is gone.

Family Offices were the easy money.

They gone.

Family Office anchors: 13% → 6% (cut in half)

Endowment anchors: 12.5% → 20% (doubled, totally ready for late 2028!)

You’re not pitching to people who take meetings and write checks anymore.

You’re pitching to institutions with committees, compliance, legal review, audit requirements. Late 2028 will be chill. See you there!

Family Office founder in 2022: Takes a call, believes your story, writes a check.

Endowment allocator in 2026: Wants your PPM, your audit opinion, your compliance manual, a committee meeting, a second opinion, and 90 days of due diligence.

Every one of those steps extends your close timeline. Which burns more cash. Which means more months of personal stress and runway burn.

We are actively introducing GPs to endowments right now for 2027/2028 closes. Informal meetings.

This isn’t formal fundraising yet. But it’s real capital with real conviction. The timeline is longer than most GPs expect, but if you’re planning for 2027/2028, endowments are absolutely possible.

[Note: we are not placement agents, we do not believe in touching carry, Lehman scale, Lehman brothers, although we do believe in the Doobie Brothers.]

So You Closed Your First $50M. Now The Real Work Starts.

You close your first $50M in 2026. You’re relieved. You should be. But here’s what comes next.

You face the fee wall. And most first-time GPs haven’t actually thought through what it means operationally.

$100M fund at 2% = $2M/year

$100M fund at 1.5% = $1.5M/year

$100M fund at 1% = $1M/year

After office, compliance, travel, and the fact that you live somewhere LPs will actually visit?

You can’t afford the senior talent you need. So you hire juniors. Smart people, but juniors.

What actually happens: Your underwriting gets looser. Your data room isn’t as clean. LP diligence takes 3-6 months longer.

You burn an extra $400-600K in G&A you didn’t budget for. Your portfolio companies don’t get the board-level mentorship they need. Your returns suffer.

When it’s time to raise Fund II, you’re in a tough spot. Not trapped forever. Just operating at a level of stress that wasn’t supposed to be there.

This is where most first-time funds get squeezed. Not failed. Squeezed.

The solution? You need to plan for the fee wall before you raise. Not after.

What This Data Actually Says

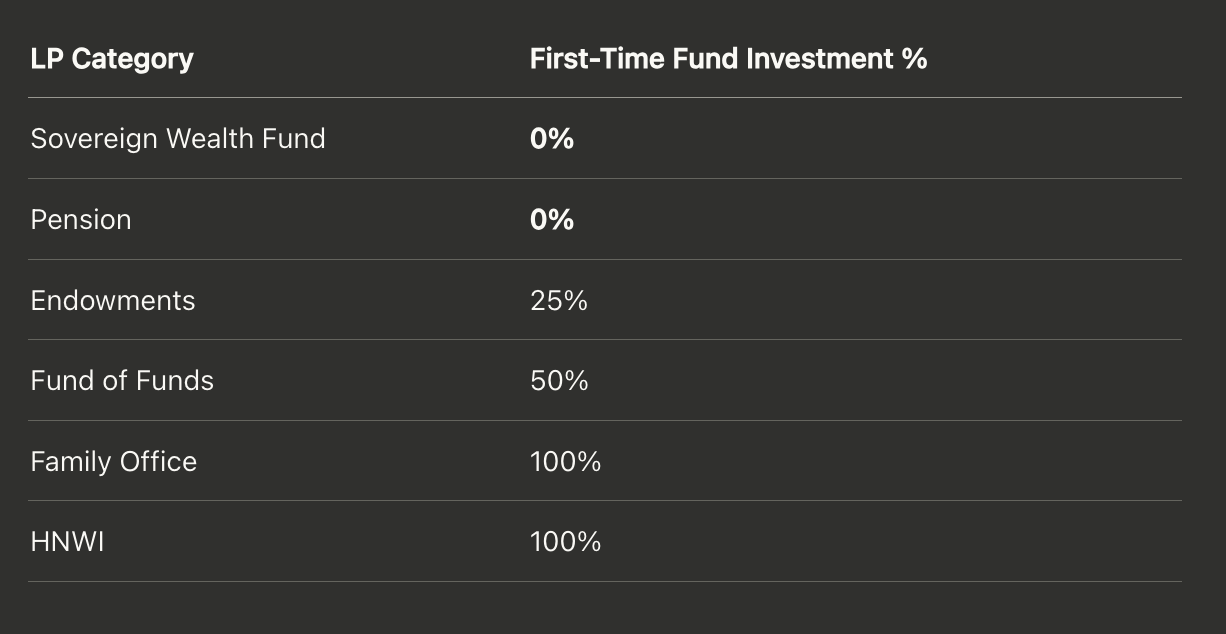

The first-time fund breakdown tells the real story:

The hard institutional money won’t touch you. Ever. Zero percent.

Your real options as an emerging manager in 2026:

Family Offices or HNWIs (they will take the risk)

FOFs (they do a mandate, but they’re kinda freakin’ picky)

Founders as LPs (rare, a total pain in the ass, and we really do not like them under roughly 400-500M AUM, juice not worth the squeeze)

Multi-stage partners betting on you personally (increasingly rare, see the founder issue)

Everything else is institutional. And institutional capital doesn’t invest in first-time funds. You see the problem here?

How You Actually Navigate 2026

Before you raise (NOW):

Fund working capital for 12 months. Not 9. Not “hoping the close happens faster.” 12 months. If you can’t, this is where to start.

Wishing and hoping is not a strategy. If you do not have working capital for 12 months, This is not happening in 2026.

Build ruthlessly lean ops. $60K/month max for 18 months. Outsource everything. Use software, not people. Your job is closing the fund, building the LP base, managing timelines. Not picking companies yet. That comes after you've actually raised. Everything else is overhead.

Know your real 2026 timeline. Talk to LPs who raised in Q4 2025. Ask what actually happened. Then add 6 months. That’s your real timeline.

Plan for the fee wall now. If you’re raising $50-100M, assume 1.5-2% fees in 2026. Can your team survive and do good work on that? If not, don’t raise at that size.

As you raise in 2026:

Kill weak prospects super f****** fast. No strong yes by meeting two? You’re done. Don’t drag out 180-day sales cycles. They’re cash killers. Those are the people that kill young funds dead. “Do we have strong reason to have you join our team?” If they don’t say “f*** yeah,” sweetie, that’s called a “hell no.”

Build operational excellence. Tight CRM, clean data room with multiple levels of access [if you do not know how to do this click here], defined reference process. Costs $10-20K. Saves $400-600K in diligence delays.

Rebudget immediately on timeline slips. Don’t pray. Replan. [Well s***, also pray. Probably doesn’t hurt.]

What Actually Works in 2026

Once you’ve solved for working capital, positioning matters. Here’s what GPs who survived 2025 are actually doing:

Hyper-Specialization. Not “we invest in AI.”

More like “we back AI infrastructure founders who’ve exited before.”

Public Brand. Direct quote from a GP: “Most of my LPs knew of me. Many are tracking me through posts.” LPs research you before meetings. Be worth researching.

Co-Investment Access. Let LPs co-invest at zero economics on your SPVs. Lowers their perceived risk. Wins capital from cautious allocators. This s*** is table stakes rn.

High-Touch Community. Direct from the data: “For Individuals we’re seeing a desire to feel more engaged. More updates, social, events, ways to help.” Treat individual LPs like community, not capital.

These four things separate the raising from the stuck. But they only matter if you didn’t burn out from working capital stress first.

The Real Talk

Here’s what makes 2026 different: The easy capital?

Poof. Gone like Ruja Ignatova.

The approval stamp shortcuts ? Gone. You’re pitching to institutional capital now, and institutional capital has process.

2028 will be fun. Gonna take a while.

Most of what you hear about 2026 fundraising focuses on positioning, brand, and LP psychology. That stuff matters. But it doesn’t matter if you’re burned out from sweating payroll for 8 months straight, looking like my man from Airplane.

What actually matters: Get clear on working capital before you do anything else.

We know capital formation for emerging fund managers better than anyone in this space.

We’ve watched what separates the GPs who raise smoothly from the ones who are constantly stressed and overwhelmed. It’s not better positioning. It’s better planning.

The GPs who are actually raising well in 2026?

They planned their working capital before they raised. They know their real timeline. They know what the fee wall looks like. Everything else?

It flows from that foundation.

The ones who are struggling? They’re doing it backwards. They’re positioning first. They’re hoping the close happens faster. They’re sweating every month.

We can help with both. But the order matters.

The Three Things That Actually Matter

If you’re raising in 2026, these are the conversations you need to have with yourself:

Do I have working capital for 12 months? Not “will I figure it out while raising.” Do I actually have it now? If the answer is maybe or no, this is where to start.

Do I understand what 2026 timelines actually cost? Extended timelines = extended personal burn. That’s the math. Can your team absorb another 6 months of personal runway? Be honest.

Can I close fast if I need to? You don’t have the multi-stage VC shortcut anymore. You don’t have the easy capital anchor anymore. You need discipline around which prospects are actually real.

If you can answer those three honestly, you know where you stand.

If you can’t, that’s the conversation to have now. Not after you’ve burned three months trying.

We have specific frameworks for this. Not theory. Tools we’ve built with 147+ firms that actually raised. Working capital modeling. Fee wall planning. Timeline discipline.

We don’t teach you how to sound good in a pitch. We teach you how to feel less stressed while you’re actually raising.

Raising in 2026? What’s actually keeping you up at night about working capital? Hit reply. That’s the conversation worth having.