🧠 Four Weeks, Four Cheat Sheets, One Wake-Up Call for Fund Managers

Precision Tools for GPs Navigating a Tough Fundraising Market

Over the past month, LP Blueprint's office hours weren’t just Q&A.

They were field tests. Four live sessions. Four tactical playbooks. Each one aimed at solving one specific choke point in the modern GP’s raise.

We didn’t theorize. We showed GPs how to fix what’s broken, fast.

👇 Here’s what dropped:

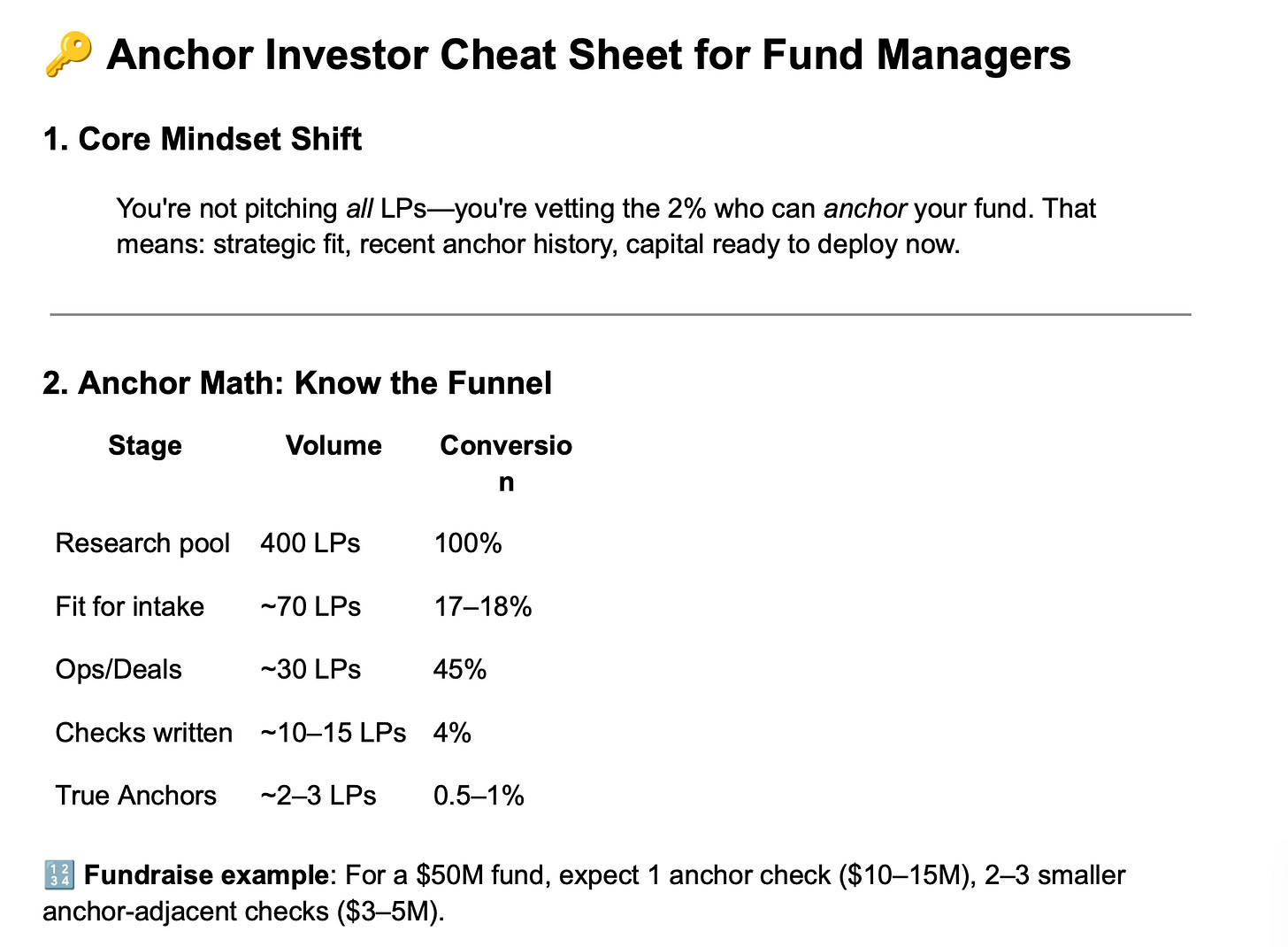

1. 🔑 The Anchor Investor Cheat Sheet

The problem: Too many GPs are courting the wrong LPs.

The fix: A battle-tested framework to identify and qualify the 2-3 anchors who will actually lead your fund. Funnel math, research tactics, Sandler-style objection handling.

Why it matters: Anchor LPs don’t just validate your fund—they drag others in behind them.

2. 🌟 From Frustration to Focus: Finding LPs with Public Data

The problem: You’re guessing who to pitch.

The fix: Scraping Form D filings, pension reports, and press trails to build an LP list that makes sense.

Why it matters: Warm intros are nice. But signals from real allocations beat vibes every time.

3. 🧠 How GPs Can Use AI to Supercharge LP Tar…

Keep reading with a 7-day free trial

Subscribe to LP Blueprint to keep reading this post and get 7 days of free access to the full post archives.